Everything about Wealth Management

Table of ContentsA Biased View of Wealth ManagementSome Known Facts About Wealth Management.Wealth Management Things To Know Before You Get ThisTop Guidelines Of Wealth ManagementThe Of Wealth Management

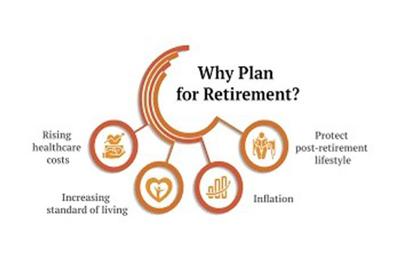

The non-financial facets consist of way of living selections such as exactly how to hang out in retirement, where to live, and also when to stop functioning completely, to name a few points. A holistic method to retired life planning takes into consideration all these areas. The emphasis that places on retired life planning modifications at various phases of life.

Others claim most retired people aren't saving anywhere near adequate to meet those standards and also need to change their way of living to survive what they have. While the amount of money you'll intend to have in your savings is essential, it's likewise a good suggestion to think about all of your expenditures.

Wealth Management Things To Know Before You Buy

As well as because you'll have a lot more spare time on your hands, you might also wish to consider the cost of entertainment and traveling. While it may be hard to come up with concrete numbers, be certain ahead up with an affordable price quote so there are not a surprises later on.

Despite where you remain in life, there are several key steps that put on practically every person during their retired life planning. The complying with are a few of one of the most usual: Generate a plan. This consists of making a decision when you intend to start conserving, when you intend to retire, and also just how much you wish to save for your utmost goal.

Examine your investments once in a while as well as make periodic adjustments. It's always an excellent idea to make any type of modifications whenever there's a modification in your way of living and when you get in a various stage in your life. Pension been available in many sizes and shapes. The guidelines as well as guidelines for each might be various.

You can and also must contribute greater than the amount that will certainly gain the company suit. Actually, some professionals recommend upward of 10%. For the 2023 tax year, participants under age 50 can add approximately $22,500 of their profits to a 401( k) or 403( b) (up from $20,500 for 2022), a few of which may be additionally matched by a company. wealth management.

Wealth Management for Beginners

The standard individual retirement account my sources (IRA) allows you deposit pre-tax bucks. This implies that the cash you save is subtracted from your revenue prior to your tax obligations are obtained. It lowers your taxed income as well as, consequently, your tax responsibility. So if you get on the cusp of a higher tax obligation bracket, buying a typical individual retirement account can knock you to a lower one.

So when it comes time to take distributions from the account, you undergo your standard tax rate during that time. Remember, however, that the cash expands on a tax-deferred basis. There are no capital gains or returns tax obligations that are assessed on the equilibrium of your account up until you start making withdrawals.

Roth IRAs have some restrictions. The contribution limit for either IRA (Roth or standard) is $6,500 a year, or $7,500 if you more than age 50. Still, a Roth has some revenue restrictions: A solitary filer can add the complete amount just if they make $129,000 or less annually, as of the 2022 tax year, as well as $138,000 in 2023.

Wealth Management - An Overview

It functions the same method a 401( k) does, permitting staff members to save money instantly with pay-roll reductions with the option have a peek at this site of a company suit. This amount is capped at 3% of an employee's annual salary.

Catch-up payments of $3,500 enable workers 50 or older to bump that restriction up to $19,000. When you set up a retired life account, the question becomes just how to direct the funds.

Below are some standards for effective retirement preparation at different phases of your life. Those starting adult life may not have a great deal of money free to invest, but they do have time to let financial investments mature, which is a crucial and also useful item of retired life savings. This is since of the concept of compounding.

Even if you can just deposit $50 a month, it will be worth 3 times more if you invest it at age 25 than if you wait to start spending up until age 45, many thanks to the joys of compounding. You could be able to spend more money in the future, however you'll never ever have the ability to offset any lost time.

What Does Wealth Management Mean?

However, it's crucial to continue conserving at this stage of retired life planning. The mix of making more money and the moment you still need to invest as well as gain rate of interest makes these years some of the best for hostile financial savings. People at this stage of retirement preparation should remain to benefit from any kind of 401( k) matching programs that their employers supply.